How Do I Read a European Real Estate Ad

Best-in-class real estate and financial market intelligence

Existent Manor Analytics

Gain an informational edge with our proprietary analytics

Learn More

REIT Research

Strengthen your investment strategies with our expert insights

Acquire More than

![]()

News

Access exclusive news and databases to stay ahead of the bend

Learn More than

Advisory & Consulting

Make better decisions with a team of independent experts on your side

Learn More

Featured Content

Differentiated and unbiased perspective for better decision-making

Scarlet Hot Property Appreciation Likely to Cool

The Light-green Street Commercial Holding Price Index® increased 0.1% in February.

2022 Sector Outlooks Have Released!

Green Street is excited to unveil the seven new 2022 U.S. Sector Outlooks. Gain an in-depth understanding of supply and demand dynamics, risks and opportunities, valuation trends, majuscule expenditures, and render expectations

Webinar: What Volition the Covid Spike Bring for U.Due south. Office in '22?

Join us for a thirty-infinitesimal discussion covering challenges the part sector experienced through '21 due to the ongoing Covid-19 pandemic and secular shifts toward working from home.

Looking Alee to '22 and Back at '21

From lingering Covid-19 concerns to ESG's impact on commercial real estate, rising aggrandizement and how Green Street can help optimize your real estate strategy, this webinar will cover fundamental issues impacting '21 and thoughts almost looking ahead to '22.

Green Street Issues Potent "Purchase At present" Signals as Cap Rates Continue to Decline

Investors could benefit from acquiring assets in most all holding sectors. The perfect storm of incredibly low bond yields, high volumes of capital flowing into private equity, and open debt markets where financing rates are well-nigh unprecedented levels, will spur continued price increases for commercial existent estate.

Product Release! Green Street's API

Integrate Greenish Street's near up-to-date proprietary private and public market data points, including 1,500+ information series attainable through fifteen+ endpoints, directly into your workflow. Gear up is a simple.

AFIRE Podcast with Dave Bragg: Herd Customs

Uncertainty surrounding remote work and politics suggest a wide range of potential outcomes for big cities, which may upend the long-running megatrend toward urbanization.

Transaction Data, Turbocharged!

Light-green Street's property transaction database coverage is deeper than ever before, having been recently expanded to include verified transactions valued at $5 1000000 and up. Nosotros at present accept over 60,000 verified transactions in our database with more than added each week.

Broker League Tables & New Special Supplement

Access Real Estate Alert's exclusive $5M and up broker rankings, enhanced transaction data, and a new complimentary special supplement.

The Year of the Rebound

At the mid-point of 2021, newly appointed Green Street Managing director of Research Cedrik Lachance offers his views on where the commercial real estate markets are headed, from a public and private market place perspective, and in the United States and Europe.

Global Function: Navigating a Hybrid World

Equally companies recall workers back to the office, how volition office fundamentals reply? What should be on office investors' radars post-pandemic and in the long-term?

For Global Retail, Opportunity Knocks: First-class!!

Every commercial property sector in Green Street'south CPPI is valued above the pre-GFC, 2007 benchmark of 100, except one: Malls, which stand at 80.3. The Mall sector CPPI index is down 17% post-Covid.

Deurbanization: A Tale of 3 Cities

San Francisco, Charlotte, and London belongings markets provide unlike answers to the question: Has the Covid pandemic reversed centuries of urbanization?

Green Street Releases New Portfolio Tools

Green Street launches its new Automated Valuation Model (AVM) offering instant, accurate and transparent single-property valuations, and Portfolio Analytics, for custom, comprehensive reports and analysis of your commercial real estate portfolios.

Go Ahead, Sweat the Small Stuff

Green Street'due south Real Manor Alert recently published its first-e'er rankings of commercial belongings brokers involved in deals valued betwixt $5 million and $25 meg, a new category for the gold-standard industry publication that until now has focused rankings exclusively on transactions of $25 meg and up.

Green Street Acquires React News

Dark-green Street expands News and Pan-European product offerings with the acquisition of React News, leading provider of exclusive European holding news.

More than a 24-hour interval Tardily and Definitely More than a Dollar Curt

Dark-green Street Co-Founder Mike Kirby spoke in depth to his alma mater about the state of the U.S. commercial real estate manufacture and the divergence of pandemic impacts across property sectors.

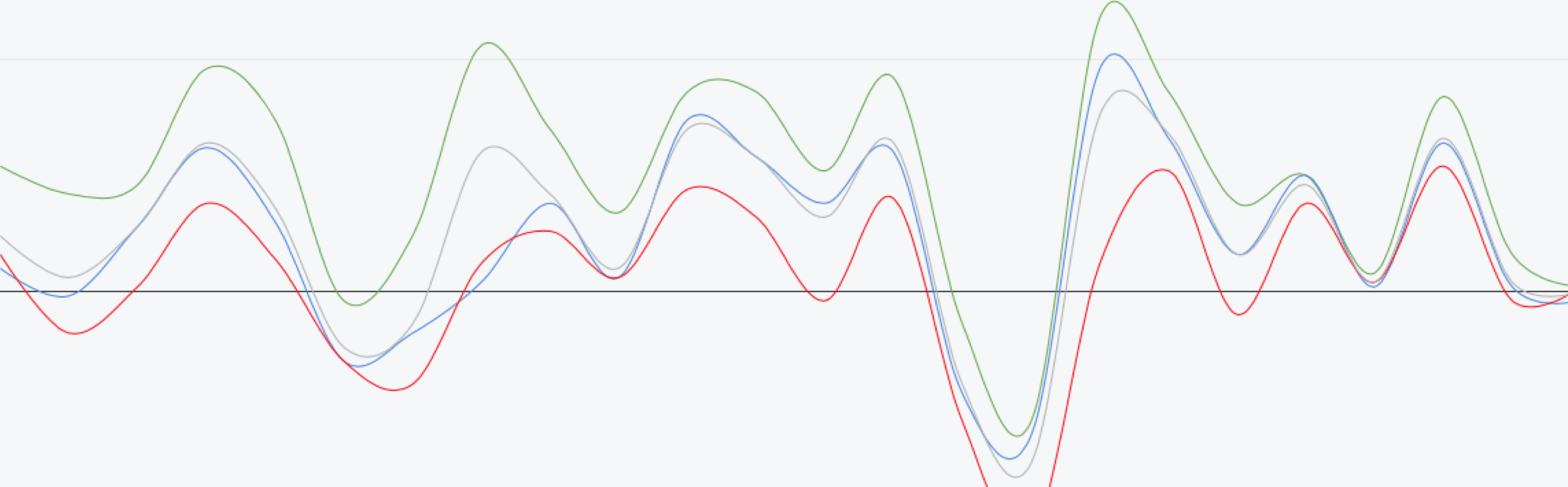

Signals from the Public Market

Observed premiums/discounts in the public market have historically been reliable predictors of futurity changes in private market prices.

New! Dark-green Street European Real Manor Analytics

Dark-green Street is proud to introduce our new European individual market place platform, European Real Estate Analytics, providing market participants with a seamless fashion to compare and underwrite real manor investments beyond geographies, property sectors, and currencies.

Over 450 years of commonage experience

Our large, experienced analyst team provides views on the global economy, REITs, individual properties and everything in between. Our analysts specialize by property type and movement beyond superficial statistical tools to evaluate properties, markets, and companies with depth.

Hypothetical Rails Record

22% Average Annualized Return on Buys

For over 25 years, our Buy recommendations for publicly-traded stocks have outperformed our Sells past an average of 21 per centum points each yr. Our team of experienced analysts has a proven rail record projecting the direction of commercial property and REIT market values.

View Rail Tape

- Purchase

- Hold

- Sell

- Universe

Contact The states

Source: https://www.greenstreet.com/

0 Response to "How Do I Read a European Real Estate Ad"

Postar um comentário